Perform comprehensive reconciliations on your submission files for accuracy and completeness.

Enabling firms to meet their most complex requirements.

Specialist technology, managed and professional services built to transform organisations.

In May 2025, a Tier 1 Bank was fined $1.45M for submitting 36.6B inaccurate CAT reports. This was due to coding errors, tech gaps, and oversight failures. Novatus Global’s En:ACT platform safeguards your firm with field-level testing, full table coverage, and transparent data lineage. Don’t risk penalties, ensure your CAT reporting is Accurate, Complete, and Timely.

How we enable firms to meet their most complex requirements:

Our award-winning technology and advisory solutions enable clients from across the financial services industry, from domestic boutiques to global tier one institutions, to meet their most complex requirements.

Our Services:

Professional Services:

We transform the daunting process of obtaining regulatory approval into a streamlined, stress-free experience. Our seasoned experts not only handle the intricate details of application preparation (including Regulatory Business Plans and financial analysis) and compliance but also provide strategic insights to ensure application success.

Novatus Global offers expert compliance services to financial firms, guiding them through the ever-changing regulatory landscape. From regulatory compliance assessments to implementing compliance programmes, we ensure that our clients meet all relevant regulatory requirements and standards.

Our resilience services are designed to help financial firms build and maintain resilience in the face of unforeseen disruptions and challenges. From business continuity planning to crisis management, we help our clients prepare for and respond to various threats, ensuring business continuity and operational resilience.

Our risk management services are designed to help firms identify, assess, and mitigate risks across their operations. We work closely with clients to develop robust risk management frameworks tailored to their specific needs, enabling them to proactively manage risks and protect their business interests.

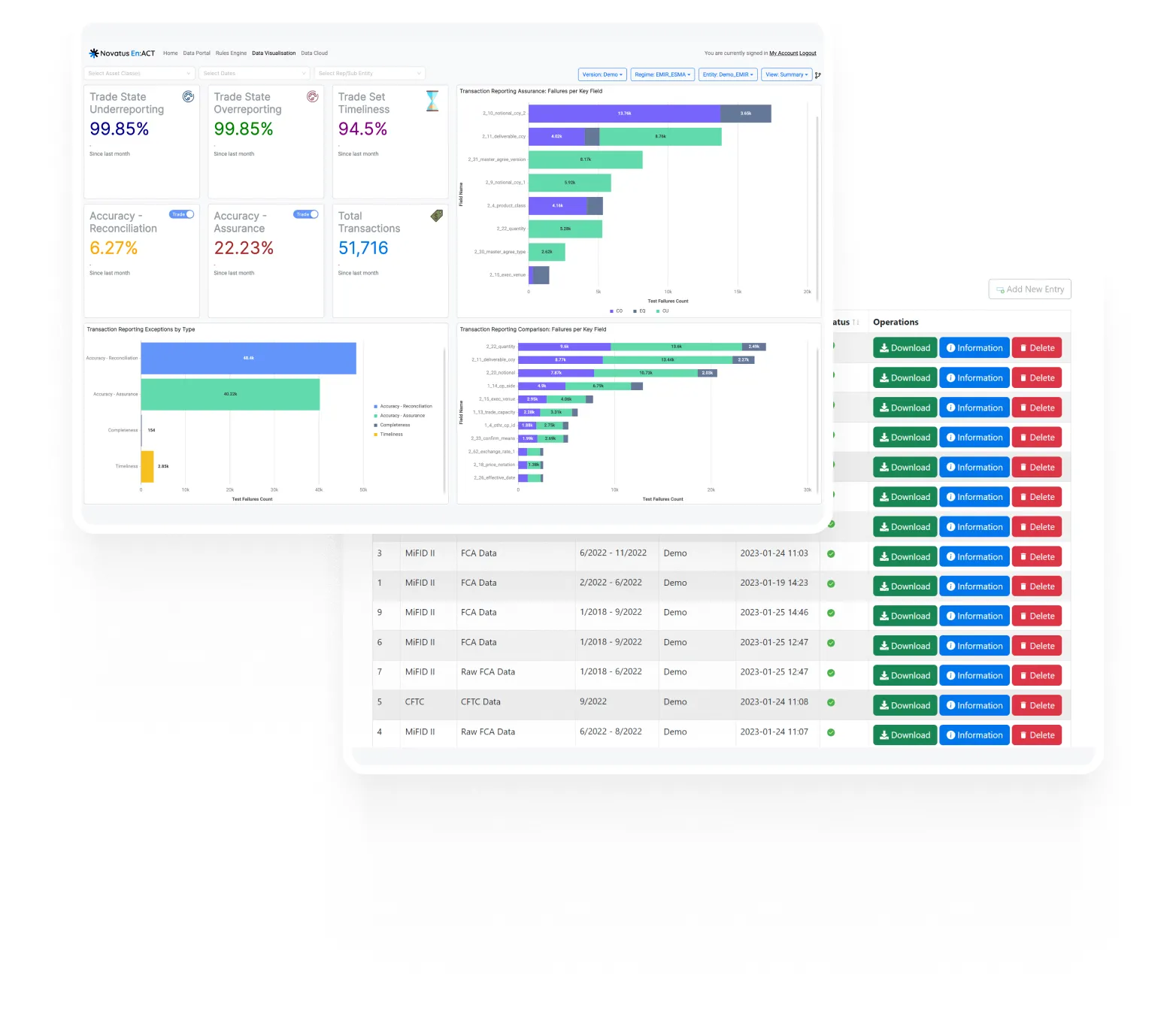

We specialise in providing comprehensive transaction reporting services to firms, ensuring accurate, complete, and timely reporting across all G20 regulatory regimes. Our expert team navigates the complexities of transaction reporting requirements, helping clients meet their regulatory obligations efficiently and effectively.

Environmental, Social, and Governance (ESG) considerations are increasingly important for financial firms looking to demonstrate their commitment to sustainability and responsible business practices. We provide comprehensive ESG services, helping clients integrate ESG factors into their investment strategies, risk management processes, and reporting frameworks.

We provide comprehensive strategy and transformation services tailored to meet the specific needs of each client. Whether you’re looking to develop and execute a strategic roadmap, drive organisational change, or implement digital transformation initiatives, our team has the knowledge and experience to support you every step of the way.

Managed Services:

We offer comprehensive Risk & Compliance as a Service solutions tailored to your specific needs. Our team of experts provides proactive risk management and compliance support, helping you navigate regulatory requirements and mitigate potential threats to your business. With our flexible and scalable service offerings, you can focus on driving growth and innovation while we handle the complexities of risk and compliance management.

Our Transaction Reporting as a Service solution ensures accurate and timely reporting across all regulatory regimes. We understand the challenges of transaction reporting in today’s complex financial landscape, which is why we offer end-to-end support to help you meet your reporting obligations efficiently and effectively. From data collection to submission, our dedicated team ensures compliance and peace of mind.

Demonstrable operational resilience is an imperative for financial institutions.

ESG (Environmental, Social, and Governance) considerations are increasingly important for businesses looking to demonstrate their commitment to sustainability and responsible business practices. We provide ESG as a Service solutions to help you integrate ESG factors into your business strategy and operations. From ESG due diligence to disclosures and reporting, we help you navigate the evolving landscape of ESG compliance and transparency.

Financial crime compliance is a critical aspect of risk management for financial institutions. Our Financial Crime Compliance as a Service offering provides comprehensive support to help you detect, prevent, and respond to financial crime risks effectively. From anti-money laundering (AML) to fraud detection and sanctions screening, our tailored solutions help safeguard your business and reputation.

Harnessing the power of data is essential for driving informed business decisions and achieving operational excellence. We offer Data, Operations, Reporting & Analytics as a Service solutions to help you implement change effectively. From data management to advanced analytics and reporting, our comprehensive services empower you to drive efficiency, innovation, and growth.

ESG due diligence is a crucial step in assessing the sustainability risks and opportunities associated with investment decisions. Our ESG Due Diligence services help investors and businesses evaluate ESG factors and integrate them into their decision-making processes. With our expertise and analytical tools, we provide valuable insights to support responsible investment and business practices.