An Introduction to the Internal Capital Adequacy and Risk Assessment (ICARA)

Firms in the asset management sector continue to look for ways to diversify and grow their business, including capitalising on increasingly popular passive strategies and technology outsourcing. With any plan to expand lines of business and maximise cost efficiencies, there is a need to balance managing risk and unlocking working capital. For the asset management sector, this balance is struck in the Internal Capital Adequacy and Risk Assessment Process (“ICARA Process”). Two years on from the implementation of the Investment Firms Prudential Regime (“IFPR”), participants in the asset management sector are still at varying degrees of maturity in their ICARA process.

From early beginnings to enabling business, we will explore the challenges firms face at different stages in their ICARA journey and the steps they can take to upgrade this process and unlock its benefits…

ICARA Stage 1 – Early Beginnings

Firms at this stage of maturity are typically new market entrants, rapidly growing firms acquiring and growing new business, and those without adequate resources across risk, compliance and finance teams.

These firms usually have an incomplete ICARA process, often failing to meet regulatory requirements and missing key FCA guidance in their processes. We find this is especially around treatment of group considerations, reverse stress testing and the methodology and results of K-Factor assessments.

Firms in this category often overcompensate in their ICARA process by taking a conservative approach to capital holdings. Whilst this can absorb shocks from unexpected changes to capital requirements, most firms are left overcapitalised. This in turn limits their ability to programmes from ordinary cashflow, reducing capacity to adapt to market trends and put more investment into growth initiatives.

ICARA Stage 2 – Meets Expectations

Firms meeting expectations are typically those with an established business that is growing moderately with minimal business change. These businesses have stable risk and finance functions that are generally meet the regulation and are responsive to FCA guidance and. Whilst the ICARA process meets basic regulatory requirements, typical areas for enhancement include:

- Capital requirements that are only calculated annually;

- Stress testing is applied on a blanket basis with no consideration for granular risks; and

- Adequacy monitored only as often as required to complete regulatory returns.

These areas of immaturity often lead to “point-in-time” capital adequacy, that doesn’t look at potential changes to requirements based on up-to-date financial information and changes to forecasts. This process fails to lend itself to the dynamic opportunity for risk management that the ICARA presents, in line with business changes.

ICARA Stage 3 – Live Analysis

Typically, medium to large firms with predictable business lines and business changes and firms with live analysis have their capital requirements built into forecasting models and management accounts. Scenario testing is undertaken on a granular level, taking into account the impact of stress scenarios on different lines of business. Governance is set up to regularly monitor financial adequacy and make decisions on capital release, ensuring the risk and finance functions are working together to support monitoring and change.

Firms in this category are able to regularly evaluate their ability to withstand financial harm and deploy capital in the business ahead of time. This contributes to a more confident management team and board, better placed to make appropriate decisions on an ongoing basis.

ICARA Stage 4 – Business Enabler

Business Enablers go beyond live analysis and utilise an incorporated risk, regulation and treasury operating model to undertake regulatory and financial analysis, delivering an optimised risk-based ICARA process. Firms in this category are often larger because percentage changes in capital requirements can unlock significant cash flow, enabling the financing of new teams and projects. These firms deploy a two-pronged approach to optimise their ICARA process.

Firstly, they undertake regular regulatory and financial analysis to assess other permittable means of calculating capital requirements, such as assessing group consolidation against group capital test requirements. This ensures that firms are adequately taking into account the most appropriate means to compute their requirements.

Secondly, business Enablers consistently review capital composition to ensure that all balance sheet assets are utilised effectively to reduce any undue burden on working capital. In combination, this ensures that firms have full visibility into the possible means of computing their requirements and how they can meet them.

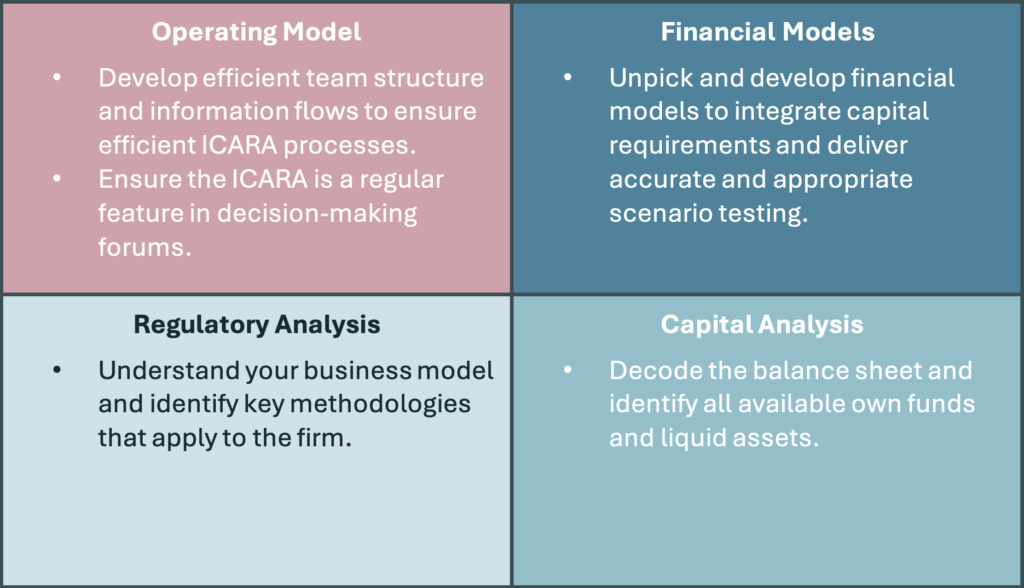

How Novatus Global Can Help With Your ICARA Process

Novatus Global are experienced in helping firms upgrade their ICARA processes by reviewing and enhancing prudential risk management processes across the key areas. This includes a tailored methodology that considers your specific operating, risk and, financial models in the context of your regulatory position and strategic initiatives.

Get in touch if you would like to discuss how we can assist your firm in utilising the ICARA to ensure that your risk and growth are adequately balanced.

The ICARA reference date is the date on which the underlying data used to perform the review of a firm’s ICARA process was prepared

What is the ICARA Process?

The Internal Capital Adequacy and Risk Assessment (“ICARA”) process is a collective term used to describe the systems used by firms to balance managing risk and unlock working capital, ultimately ensuring that its operations can be wound down in an orderly manner.

Has ICARA Replaced ICAAP?

With its introduction on 1st January 2022, the IFPR introduced the requirement for all firms to develop and complete an Internal Capital Adequacy and Risk Assessment process. The ICARA process should then be conducted annually or upon significant business change.