Since the introduction of MiFIR on 3 January 2018, investment firms across the EU and UK have been mandated to report transactions involving natural persons by using a specific set of identifiers. Following Brexit, reporting requirements for UK nationals under EU MiFIR have changed, making it crucial for firms to update their reporting processes accordingly.

When it comes to MiFIR transaction reporting, identifying natural persons can be more complex than dealing with corporate entities. While legal entities are straightforwardly identified using their Legal Entity Identifier (LEI), natural persons require specific types of identification depending on their nationality. Accurate reporting of these natural person identifiers is essential to meet regulatory obligations and avoid compliance issues.

Understanding Annex II of RTS 22

Annex II of RTS 22 outlines the rules for determining which natural person identifier should be used for based on the person’s nationality. Annex II categorises identifiers by priority, ensuring the highest-ranking natural person identifier is reported whenever available. The rules apply equally to both EU and UK investment firms, albeit with some differences in handling UK nationals post-Brexit.

Here’s a breakdown of the key rules:

- UK Nationals Pre-Brexit onboarding: Update records to include passport numbers where national insurance numbers were previously used.

- UK Nationals Post-Brexit onboarding: Ensure passport numbers are collected at the point of onboarding.

- EEA Nationals: Use the two-letter country code and the highest priority identifier specified in Annex II. If a national identifier (e.g., a national insurance or social security number) is unavailable, firms should use CONCAT as a secondary identifier.

- Non-EEA Nationals: For individuals from outside the EEA (including the UK), firms must report either the national passport number or CONCAT, depending on availability.

- Multiple Nationalities: Where a person holds more than one EEA nationality, the firm should use the country code that comes first alphabetically, along with the corresponding identifier.

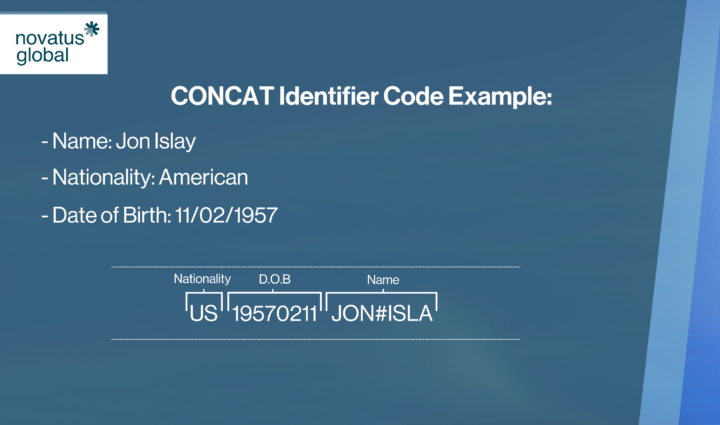

What is CONCAT?

CONCAT is a derived identifier used when a higher priority national identifier is unavailable. It combines the following elements:

- The two-letter country code

- Date of birth in the format YYYYMMDD

- The first five characters of the person’s first name

- The first five characters of the person’s surname

If a name has fewer than five characters, the remaining spaces should be filled with ‘#’. Additionally, prefixes and punctuation in names should be excluded.

Practical Recommendations for Compliance When Using National Identifiers

Review and Update Onboarding Processes

Investment firms should regularly review their client onboarding procedures to ensure they capture the correct national identifiers based on the latest regulatory requirements. This includes updating client records to reflect any changes in identifier priority post-Brexit.

Ensure Data Accuracy and Completeness

Maintaining accurate and complete records is critical for successful MiFIR transaction reporting. Firms should:

- Validate collected national identifiers to ensure they meet Annex II specifications.

- Implement robust internal checks to verify that the highest priority identifier is used.

- Periodically audit their client database to identify and rectify any missing or outdated information.

Conclusion – National Identifiers & MiFIR Transaction Reporting

Correctly reporting natural person identifiers under MiFIR is a nuanced but essential aspect of regulatory compliance. Firms must stay updated on changes in reporting requirements, particularly those related to Brexit, and ensure their processes are aligned with Annex II of RTS 22.

Navigating the complexities of MiFIR reporting can be challenging. At Novatus Global, we provide expert guidance and tailored solutions to help firms meet their regulatory obligations with confidence. Contact us today to learn how we can support your compliance journey.